“No worries” on year-end funding squeeze say the experts. We have to get there first. A confluence of risks elevates red flags around and after the election.

September 2020

Over the decades in this goofy business, I have offered few market calls. I have offered few qualitative assessments of concern. Our group is a derivatives team and that means numbers, not touchy-feely stuff. Well, this is one of the few times I feel compelled to get on the soapbox and highlight the convergence of under-anticipated risks.

Year-end funding is an anticipated risk. All of the major Wall Street firms are in the ‘no concern’ basket with the last, Zoltan Pozsar (CS), rolling over last week. I concur, if you have a warehouse full of Treasury securities, there will be no problem funding at year end. And, I’m not really excited about year end, given that we have to get through the election first.

This will be a quick discussion about market-structure changes, VaR impact on credit lines, and the risk of a March-like pounding in the mortgage market.

The market-structure change is: Prime Money Market Funds (e.g. Vanguard, et al) have, in the last few weeks, eliminated their purchases of commercial paper. These funds are going to an ‘all government’ holdings model. Who really cares about CP? Heck, less than 1% of bank debt is funded through CP. CP fell apart (again) during the Covid Crisis—3mo CP didn’t trade for weeks.

While CP isn’t a big deal as a percent of funding, it’s a huge deal in terms of the production of LIBOR rates. Other than overnight, almost NOTHING actually trades, interbank, in LIBOR. CP is the main tool for survey banks—the banks that generate rates for ICE to publish term LIBOR—to justify LIBOR levels. When CP goes away, LIBOR rates are largely guesswork; nonetheless, unimpeachable due to survey banks being protected through 2021 (LIBOR’s ultimate retirement date).

About six weeks ago, we had concerns for the unimpeachable ‘integrity’ of survey banks’ LIBOR settles. Our solution was purchasing PUT options on Dec20 and Jan20 Eurodollars. While the underlying Eurodollar futures are modestly higher in price, the options are unchanged as volatility has risen. Today, the concern has moved more ‘mainstream’ with (source: Bloomberg):

“…tertiary and quaternary alternatives”—just outside the bandwidth of Tea Leaves and Tarot Cards.

Unsecured CP was/is critical to allowing survey banks to justify term LIBOR submissions. Without it, the tertiary and quaternary inputs will get reduced to, “Where will you lend money, unsecured, for three months? Or 2wks, 1mo, 6mo, or a year?” The answer is uncertain. My answer would be, “Nowhere near 15bps over a loan collateralized with a Treasury (e.g. SOFR or term repo).”

So, the perceived market-structure risk is that term LIBOR (justified at some level by bank CP transactions) will be reduced to ‘what the survey banks think is a fair unsecured rate’. If the funding market is stable and the U.S. Dollar continues to drift lower, 3m LIBOR probably will hang around SOFR+15bps. The problem is option implied volatility into and through the election is holding in at levels that suggest all is not well.

Without overdoing the analysis, option implied volatility tells the story of the market’s best guess at a one standard deviation move for the underlying instrument on an annual basis. If we see EDZ0 iVol at about 63% and underlying at 28bps, the 1-STD annual range expectation would be:

+/- 28bps*0.63 = +/-17.6bps

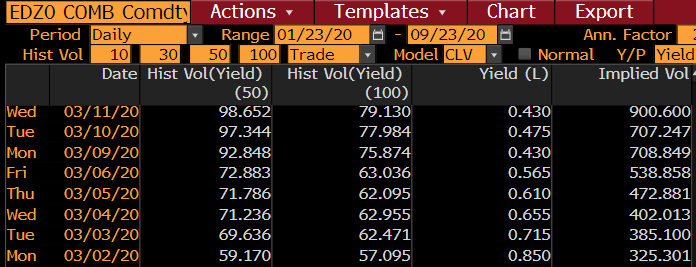

The concern, as I view it, is that the election seems to be setting up for no results for an extended period. If the race is less than a landslide, option volatilities can (and will, in my opinion) jump hyperbolically. How bad can it get? In May we saw a blip from 80%->110% iVol. Then there are jumps during periods of pandemonium that look more like this (source: Bloomberg):

(far right column for Implied Volatility)

Ok, so volatility can go crazy even if the underlying isn’t moving too much. Who cares?

Implied volatility (and realized vol) have a large impact on virtually all non-bank, leveraged finance companies. When volatility increases, the Value at Risk (VaR) models at banks grow increasingly defensive.

The VaR models, in the simplest form, use standard deviation and confidence to determine potential ‘worst-case’ outcomes. Since option implied volatility is the markets’ best guess at forward risk, increasing volatility increases the range of probable outcomes. The knock-on impact is that fat-tail (e.g. multi-sigma, low probability events) becomes more probable. In the eyes of risk management, the probability of a disastrous outcome is increasing. And what do the banks do when this happens? They cut risk. That means “reduce credit lines” and “increase margin requirements”. Anyone around in March got a pretty good look at how quickly these dominoes fall.

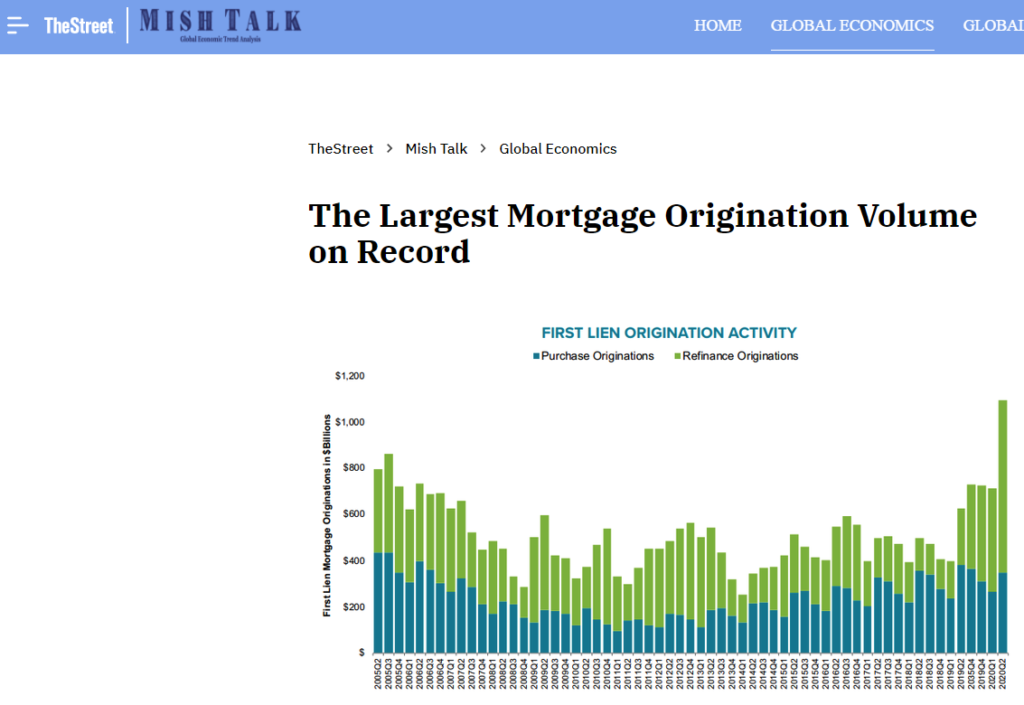

The final piece in my envelope of concern is risk to some mortgage originators. With originations at all time highs, most non-bank originators are through their existing lines (used up by TBA shorts). We have set up for a replay of March/April. Sourced from TheStreet.com.

- LIBOR, the benchmark for cost of funds for most non-bank fincos (aka ‘We borrow at LIBOR+X’), is at risk due to limited legit reference data (CP). Given any systemic concern that elevates volatility, it is likely the survey banks push LIBOR higher—all they have to do is decide it should be higher. This explicitly raises the cost of funds for floating rate borrowers (e.g. warehouse, LOC, revolvers, etc.). This is the least concerning but, nonetheless, a potentially exacerbating risk factor.

- Implied volatility increases may push bank VaR risk models that require reduction in credit lines and increase in margins for OTC derivatives.

- Reduction in lines to non-bank mortgage originators will be problematic for SOME. They will be forced to cover short TBAs, likely into a rallying market, and meet losses with cash—inasmuch as loan closing rates are still well behind.

JC- For The Fixed Income Group at RJO

DISCLAIMER

This material has been prepared by a sales or trading employee or agent of R.J. O’Brien and is, or is in the nature of, a solicitation. This material is not a research report prepared by R.J. O’Brien’s Research Department. By accepting this communication, you agree that you are an experienced user of the futures markets, capable of making independent trading decisions, and agree that you are not, and will not, rely solely on this communication in making trading decisions.

DISTRIBUTION IN SOME JURISDICTIONS MAY BE PROHIBITED OR RESTRICTED BY LAW. PERSONS IN POSSESSION OF THIS COMMUNICATION INDIRECTLY SHOULD INFORM THEMSELVES ABOUT AND OBSERVE ANY SUCH PROHIBITION OR RESTRICTIONS. TO THE EXTENT THAT YOU HAVE RECEIVED THIS COMMUNICATION INDIRECTLY AND SOLICITATIONS ARE PROHIBITED IN YOUR JURISDICTION WITHOUT REGISTRATION, THE MARKET COMMENTARY IN THIS COMMUNICATION SHOULD NOT BE CONSIDERED A SOLICITATION.

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results. Trading advice is based on information taken from trades and statistical services and other sources that R.J. O’Brien believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades.

CONTACT

222 South Riverside Plaza, Suite 1200

Chicago IL, 60606

P. (800) 367-3349

fig@rjobrien.com

© 2025 R.J. O'Brien & Associates LLC. | Site by :: kirkgroup

Futures trading involves the substantial risk of loss and is not suitable for all investors. Past performance is not indicative of future results.