Hedge LIBOR Funding Volatility Risk

July 2020

Trade:

Buy MAR 2021 (EDH1) 99.625/99.500 put spread for 1.0 bp.

Strike prices = 0.375 3M LIBOR Long Leg/0.50 3M LIBOR Short Leg

Cost is $25 per spread

Logic:

If banks or funding markets become dislocated again before March of 2021,

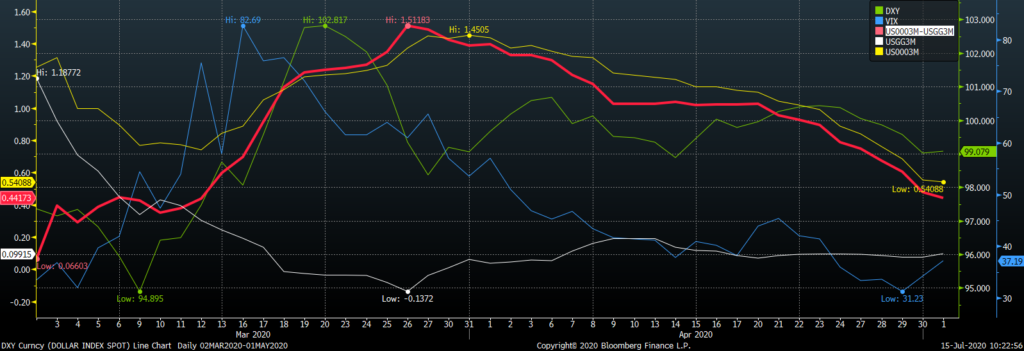

3M LIBOR/3M T-BILL spread should blow out (red line on chart below).

Coverage:

11.5:1 max return at terminal value/expiration

How many put spreads do you need? $25 x 11.5 per one spread = $287.50 max payout

If one needs to cover $2.875mm: 10,000 spreads or $250k in premium outlay

The Fixed Income Group

A Division of RJ O’Brien

fig@rjobrien.com

800.367.3349

Link to PDF Here

DISCLAIMER – This material has been prepared by a sales or trading employee or agent of R.J. O’Brien and is, or is in the nature of, a solicitation. This material is not a research report prepared by R.J. O’Brien’s Research Department. By accepting this communication, you agree that you are an experienced user of the futures markets, capable of making independent trading decisions, and agree that you are not, and will not, rely solely on this communication in making trading decisions.

DISTRIBUTION IN SOME JURISDICTIONS MAY BE PROHIBITED OR RESTRICTED BY LAW. PERSONS IN POSSESSION OF THIS COMMUNICATION INDIRECTLY SHOULD INFORM THEMSELVES ABOUT AND OBSERVE ANY SUCH PROHIBITION OR RESTRICTIONS. TO THE EXTENT THAT YOU HAVE RECEIVED THIS COMMUNICATION INDIRECTLY AND SOLICITATIONS ARE PROHIBITED IN YOUR JURISDICTION WITHOUT REGISTRATION, THE MARKET COMMENTARY IN THIS COMMUNICATION SHOULD NOT BE CONSIDERED A SOLICITATION.

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results. Trading advice is based on information taken from trades and statistical services and other sources that R.J. O’Brien believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades.

CONTACT

222 South Riverside Plaza, Suite 1200

Chicago IL, 60606

P. (800) 367-3349

fig@rjobrien.com

© 2025 R.J. O'Brien & Associates LLC. | Site by :: kirkgroup

Futures trading involves the substantial risk of loss and is not suitable for all investors. Past performance is not indicative of future results.