ICE Agency and Jumbo Rate Lock Futures

June 2022

Every business day, Ellie Mae collects data on mortgage rates that are locked. They see roughly 40-60% of all rate locks. Because some rates are impacted by upfront borrower payments (points to buy down rate), the rate data is homogenized into Annual Percentage Rate (APR). It is this APR data that underpins valuation for both the Agency and Jumbo Rate Lock futures. At monthly futures settlement, it is the final APR that determines the futures’ final value.

Because the lock data is real-time, these futures ARE the primary rate in the mortgage market. TBAs, as the alternative, are the secondary rate. While the primary/secondary yield spread is indicative of profitability for residential lending, there are many more applications for usage of Rate Lock futures.

In secondary marketing departments, many find that only a small percentage of loans are being delivered into 30yr UMBS (the Agency data excludes Ginnie—Fannie and Freddie only). With monthly drops quite severe and special, and delivery scarce, many secondary operations are looking for ways to ‘dodge the drop’. We see cross-hedging in Treasury futures and swap futures frequently today—solely as a method to reduce drop cost on pipeline risk management strategies. The Agency Rate Lock future is a better choice here:

- Mortgage: Mortgage basis

- Amortizing risk vs amortizing risk (more curve-accurate than key rate or 5s/10s blend hedges)

- Non-convex (shorting Treas or Swap results in more negative convexity)

In the case of Jumbo pipeline and bulk hedging, there are no like-kind hedge instruments. We have historically used key rate strategies to fix net-interest-margin. Some have tried using TBAs which has been historically costly and marginally effective. Now there is a legit, like-kind hedge instrument: Jumbo Rate Lock futures.

On the MSR hedging side, most strategies that combine Treasury futures and options, swap futures and TBAs, seek to emulate sensitivity to primary rates. Since the MSR hedge concept is: “Get a position in interest rates so that if rates decline, and my MSR strip has economic incentive to refi, we will have a gain in the hedge to offset the probable loss.” Well, for MSR hedgers, access to a primary rate hedge (vs a compilation of instruments to emulate primary risk) is a homerun.

Construction of the future is straight forward: 100 – Ellie Mae APR = Futures Price

So, at a 5.5% APR level, the futures price would be 100-5.5 = 94.50

The futures will likely trade above and below fair value—depending on the anticipated rate at maturity.

Final valuation will be absolute: 100 – Ellie APR

These futures will observe monthly settlement dates consistent with the TBA market.

For those that have Bloomberg access, five years of historical APR data can be accessed via:

Agency: LRC30APR<Index>

Jumbo: LRJ30APR<Index>

Alternatively, reach out to FIG@rjobrien.com or Harvey.Flax@ICE.com for more info and history on all Ellie data.

The Numbers

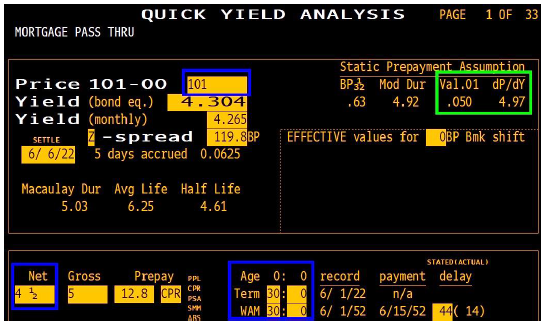

Both the Agency and Jumbo futures have a fixed interest rate sensitivity (DV’01) of $50/basis point in rate change. Because of exchange conventions that retro-fit ‘futures contract size’ to rate sensitivity, the specs make these futures look like $500k notional. In comparison to a new production 30-year, the Rate Lock futures will be closer to 1:1 per $100,000. For instance, consider a new production 30-year, run at a 12.8 CPR:

Units are not shown, but (neon green box) “Val .01” indicates a rate sensitivity of $500 per $1million face loan.

In this case, $1mm face of new production would require -10 RL futures:

- DV’01 Loan: $500 DV’01

- Future: $50

- $500/$50= 10 (as a hedge, -10)

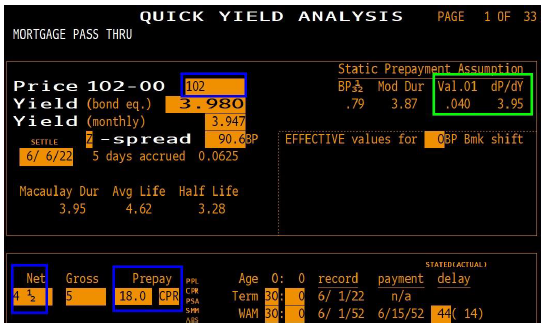

Jumbo loans are often assumed to pre-pay more rapidly. Using an 18CPR and 102 price on a Jumbo 4.5 pass thru rate, we find:

In the case of the speedier Jumbo new production 30-year, we find a DV’01 for the loan of $400 per $1mm face of loan. Easy hedge ratio calculation:

- DV’01 Loan = $400/$1mm

- DV’01 Jumbo Future = $50

- $400/$50 = -8 Jumbo futures to hedge

Most 3rd party secondary systems generate a dv’01 for pipeline exposure. Covering some portion of that DV’01 with Rate Lock futures is, quite literally, no tougher than “divided by $50”.

Likewise, for MSR risk analysis, the normal contribution of TBA longs is netted from total risk before key rates are generated. Again here, Rate Lock futures are a straight-up $50/per contract DV’01 add. Non-convex instruments are VERY easy to add to any risk system making these contracts super-easy to implement.

-JC, for The Fixed Income Group at RJO

DISCLAIMER This material has been prepared by a sales or trading employee or agent of R.J. O’Brien and is, or is in the nature of, a solicitation. This material is not a research report prepared by R.J. O’Brien’s Research Department. By accepting this communication, you agree that you are an experienced user of the futures markets, capable of making independent trading decisions, and agree that you are not, and will not, rely solely on this communication in making trading decisions.

DISTRIBUTION IN SOME JURISDICTIONS MAY BE PROHIBITED OR RESTRICTED BY LAW. PERSONS IN POSSESSION OF THIS COMMUNICATION INDIRECTLY SHOULD INFORM THEMSELVES ABOUT AND OBSERVE ANY SUCH PROHIBITION OR RESTRICTIONS. TO THE EXTENT THAT YOU HAVE RECEIVED THIS COMMUNICATION INDIRECTLY AND SOLICITATIONS ARE PROHIBITED IN YOUR JURISDICTION WITHOUT REGISTRATION, THE MARKET COMMENTARY IN THIS COMMUNICATION SHOULD NOT BE CONSIDERED A SOLICITATION.

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results. Trading advice is based on information taken from trades and statistical services and other sources that R.J. O’Brien believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades.

CONTACT

222 South Riverside Plaza, Suite 1200

Chicago IL, 60606

P. (800) 367-3349

fig@rjobrien.com

© 2025 R.J. O'Brien & Associates LLC. | Site by :: kirkgroup

Futures trading involves the substantial risk of loss and is not suitable for all investors. Past performance is not indicative of future results.