ICE/Ellie Mae Primary Mortgage Rate Lock Futures Markets are Up and Streaming—Open to Trade

June 2022

Ellie Mae gathers >40% of daily rate lock data for Conventional 30 year (FN/FHR) and Jumbo 30 year. The rate reported is generated as an Annual Percentage Rate. The loan-balance-weighted average APR is reported next-business-day. The last five-ish years of data for both the conventional and jumbo silos can be found on Bloomberg via:

- Conventional: LRC30APR<Index>

- Jumbo: LRJ30APR<Index>

The acronyms on Bloomberg for the TRADE-ABLE Futures are:

- Conventional: VAIA <Comdty> CT <Enter>

- Jumbo: VJIA<Comdty>CT<Enter>

The symbology on Refinitiv is:

- Conventional: <0#C30C:>

- Jumbo: <0#SJO:>

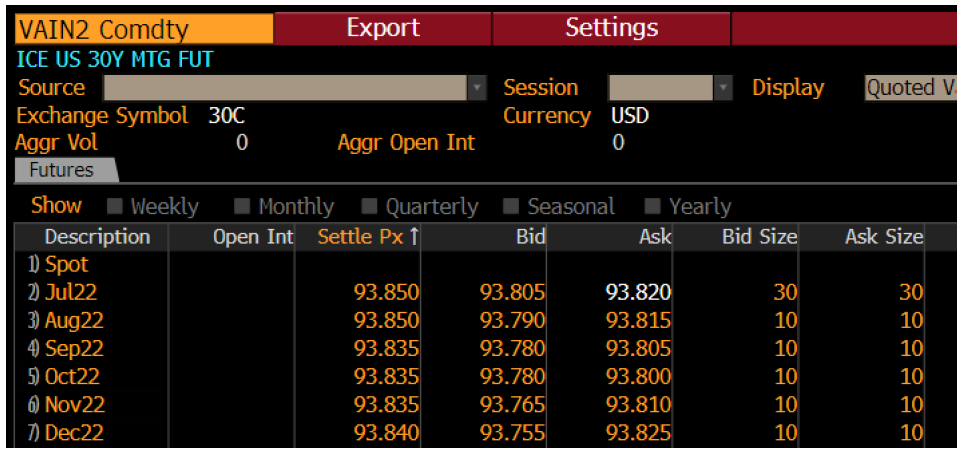

Looking at the Conventional Future on Bloomberg, we see:

Both Conventional and Jumbo trade at a price: 100 – Futures Price = Implied Primary Rate. The July’22 future shows 93.805 X 93.82. In rate terms, 6.195% @ 6.180%. The futures settle on SIFMA settle dates (July 14, 2022 here), so the ‘proposition’ is: “Where will the all-inclusive PRIMARY conventional rate be on July 14?” The ‘all-inclusive’ means pass-through rate + servicing + G-Fee + xxx; the actual all-in borrower APR. All contracts that are not rolled, CASH settle (nothing to deliver) to the Ellie Mae posted value for settle date.

Each RL futures contract has a tick value (bp value) of a FIXED $50/basis point. Unlike TBA and other mortgage product, this future is non-convex. Since the sole determinant of settlement value is the Ellie Mae APR, there is no fixed coupon, no cheapest-to-deliver, no WAM—this is a straight PRIMARY RATE product. A change in futures price from 93.80 to 93.81 results in $50 P&L (gain for the long, loss for the short). Someone in Secondary/Pipeline risk management will likely be SHORT these futures to hedge ‘rates up’. A trader on the MSR side will likely be LONG these contracts to hedge ‘rates down’.

Because there is NO ‘fixed coupon’ nor a physical loan delivery, the drop more closely emulates the financing curve (amortizing SOFR) than anything like TBA. Month-to-month is much flatter.

For SECONDARY/Conventional, this is a huge opportunity. If your deliveries into UMBS (like most) are <10%, these futures offer an alternative to substantially cut the drop cost via cross hedging. Of course, the product is non-convex/linear, so the risk profile is different. While each pipeline risk management team will have their own view, I suspect over time that the Conventional Rate Lock futures become a meaningful percentage of total hedge. When drops are steep, the RL product is highly enticing. When drops flatten, percentage of RL hedge likely declines.

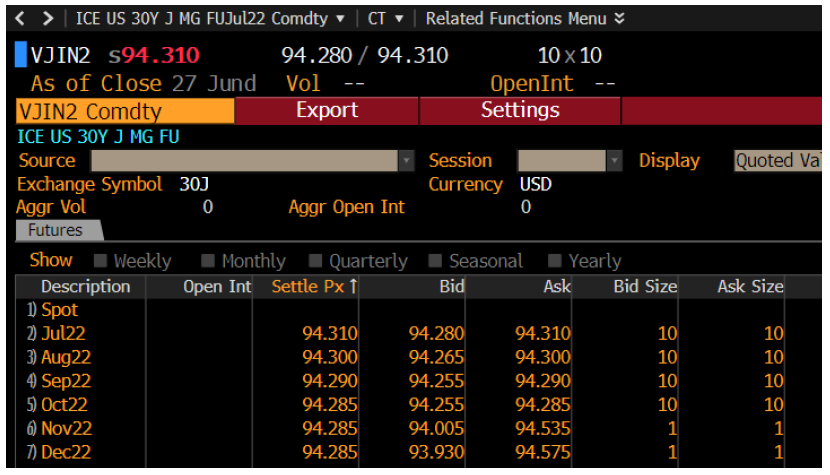

For SECONDARY/JUMBO—there is finally a functional hedge vehicle with visibility out the curve for primary jumbo rates. Current forward Jumbo looks like this:

For SECONDARY/Extended Rate Locks/Builder Forwards/Lock’n’shop—there is now a product that will get you out the curve further than the TBA stack. Ask FIG about combining options with this product.

For MSR hedgers—Finally, a PRIMARY RATE hedge vehicle! Straight up DV’01 match—no key rate buckets. No convexity mis-match. Way cheaper than CMM.

For those with flexibility to use a new product, it’s time to get involved. When there is sufficient liquidity and open interest in these futures, OPTIONS will be listed. Monthly cash-settle means no ‘getting trapped’ in a new product. As always, everyone should determine the appropriateness of any risk transfer vehicle for their institution. If you use a 3rd Party Risk Management system, please contact your vendor and tell them to get this product into their software.

While the notional value of the future is shown at $500,000, this value is a function of the fixed $50/bp contract construction. Crudely, each 1 RL Future is closer to $100k of new production UPB. If your risk management system calculates the DV’01 (rate sensitivity) of a loan at $450/$1million, your hedge ratio is: $450/$50 = 9 RL Futures per $1million loans. If you need $50,000 in DV’01 coverage on MSR risk, you calculate $50,000/$50 = 1,000 RL futures. Often, Jumbo will be analyzed at faster prepay speeds and shorter durations/lower dv’01s. So, a new production Jumbo may have $350 per $1million face in dv’01– thus, $350/$50 = 7 Jumbo RL futures.

Call the RJO Fixed Income Group desk (800-367-3349) or email us at FIG@rjobrien.com to set up a call or to ask any questions.

The risk of loss in trading futures and/or options is substantial, and each investor and/or trader must consider whether this is a suitable investment. See our full disclaimer at www.rjobrien.com

DISCLAIMER This material has been prepared by a sales or trading employee or agent of R.J. O’Brien and is, or is in the nature of, a solicitation. This material is not a research report prepared by R.J. O’Brien’s Research Department. By accepting this communication, you agree that you are an experienced user of the futures markets, capable of making independent trading decisions, and agree that you are not, and will not, rely solely on this communication in making trading decisions.

DISTRIBUTION IN SOME JURISDICTIONS MAY BE PROHIBITED OR RESTRICTED BY LAW. PERSONS IN POSSESSION OF THIS COMMUNICATION INDIRECTLY SHOULD INFORM THEMSELVES ABOUT AND OBSERVE ANY SUCH PROHIBITION OR RESTRICTIONS. TO THE EXTENT THAT YOU HAVE RECEIVED THIS COMMUNICATION INDIRECTLY AND SOLICITATIONS ARE PROHIBITED IN YOUR JURISDICTION WITHOUT REGISTRATION, THE MARKET COMMENTARY IN THIS COMMUNICATION SHOULD NOT BE CONSIDERED A SOLICITATION.

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results. Trading advice is based on information taken from trades and statistical services and other sources that R.J. O’Brien believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades.

CONTACT

222 South Riverside Plaza, Suite 1200

Chicago IL, 60606

P. (800) 367-3349

fig@rjobrien.com

© 2025 R.J. O'Brien & Associates LLC. | Site by :: kirkgroup

Futures trading involves the substantial risk of loss and is not suitable for all investors. Past performance is not indicative of future results.