SOFR Transition Concerns: Was Hand-Wringing. Now Is Trading.

November 2020

A year from now, anything basis-LIBOR is going to be a big problem. True, moving to SOFR without cost-of-funds tied to SOFR (not LIBOR+X as it is today) makes little sense. Every day that passes creates option value FOR the dealer community. Option value in terms of negotiating LIBOR->SOFR conversion spreads and credit adjustments. Option value in terms of liquidity for liquidating OTC LIBOR-Based derivatives and credit lines. While it’s rarely good to be first, it’s almost never good to be late when the ‘other side’ holds the cards.

Harkening back to April, LIBOR seemed moored at higher levels as survey banks saw no need to lower the rate. International demand for USD was enormous and increasing as USD that normally flowed via commerce, well, stopped with Covid. While the Fed was actively supporting secured funding channels (esp. repo, and thus SOFR), they were very slow to support unsecured funding markets (esp. LIBOR & CP).

Nothing worth mentioning trades in 3mo/6mo/1yr LIBOR. Didn’t in April. Doesn’t now. There are a few transactions in CP/CD markets that survey banks reference, but it’s basically their interpretation of LIBOR implied by cross-currency and FX OIS levels—interpretation.

The Fed did finally cave. They offered USD credit lines (via swaps) to every central bank with a phone or computer. The Fed’s hint of, “we’d rather not” was in the lending rates offered via swaps and the CPFF. It was enough to get 3mo LI back down toward 25bps, a large concession to secured funding at 5bps at the time.

The US dollar is not surging any more. International commerce has achieved some sense of normalcy and thus created USD flow to non-dollar institutions and banks.

Most ‘prime’ money market funds have now converted to ‘government’ funds.

Bottom line: The Fed is going to pull the supports that are doing nothing: swap lines and CPFF. These are disaster insurance policies for the unsecured markets. The Fed wants secured. Deadline 12/31/21.

When this happens, those still ‘in LIBOR’, are the folks left on the tightrope as the safety nets are pulled. Arguably, the dealers who will have transitioned nearly all of their risk, will be on either end of the rope, shaking the line.

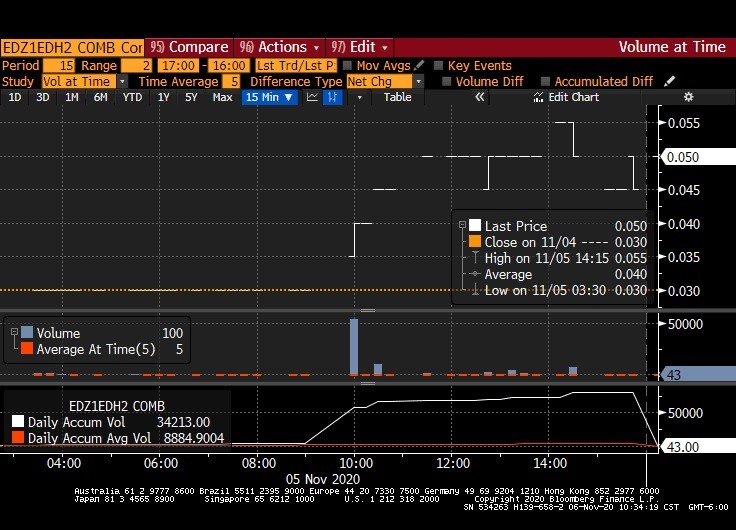

The front-end, plumbing analysts see this coming. Up until yesterday, it was talk. Yesterday, an entity placed a hedge (or bet) that the timeline for conversion is too compressed now. The trade they executed was buying $60bb EDZ’21 and selling EDH’22. This trade IS a “LIBOR screams higher post 12/31/21” position.

Admittedly, not the most exciting chart. About 60,000 of these spreads traded yesterday with the aggressor as the buyer. Someone thinks the blowout for LIBOR is unavoidable. I’d argue it’s only unavoidable for those who do not act. Most large banks expect to be all-but-fully transitioned to SOFR for their securities, loans and cleared derivatives by June/July’21. The big problem is the banks’ reluctance to transition floating rate lines: warehouse, revolvers, etc. Those are one-way trades though—if LIBOR screams higher, winner winner chicken dinner for the line-providers.

Yesterday’s transaction that isolates LIBOR over the LIBOR-end-date is a friendly warning. Everything doesn’t have to be SOFR today or tomorrow. But, in my opinion, the vast majority of all LIBOR lines, loans, securities and bilateral transactions need to be gone by end of Q1/21.

DISCLAIMER This material has been prepared by a sales or trading employee or agent of R.J. O’Brien and is, or is in the nature of, a solicitation. This material is not a research report prepared by R.J. O’Brien’s Research Department. By accepting this communication, you agree that you are an experienced user of the futures markets, capable of making independent trading decisions, and agree that you are not, and will not, rely solely on this communication in making trading decisions.

DISTRIBUTION IN SOME JURISDICTIONS MAY BE PROHIBITED OR RESTRICTED BY LAW. PERSONS IN POSSESSION OF THIS COMMUNICATION INDIRECTLY SHOULD INFORM THEMSELVES ABOUT AND OBSERVE ANY SUCH PROHIBITION OR RESTRICTIONS. TO THE EXTENT THAT YOU HAVE RECEIVED THIS COMMUNICATION INDIRECTLY AND SOLICITATIONS ARE PROHIBITED IN YOUR JURISDICTION WITHOUT REGISTRATION, THE MARKET COMMENTARY IN THIS COMMUNICATION SHOULD NOT BE CONSIDERED A SOLICITATION.

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results. Trading advice is based on information taken from trades and statistical services and other sources that R.J. O’Brien believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades.

CONTACT

222 South Riverside Plaza, Suite 1200

Chicago IL, 60606

P. (800) 367-3349

fig@rjobrien.com

© 2025 R.J. O'Brien & Associates LLC. | Site by :: kirkgroup

Futures trading involves the substantial risk of loss and is not suitable for all investors. Past performance is not indicative of future results.