The “Credit/Risk” Add-On to New RFR’s, SOFR and Ameribor (part 1)

January 2021

The ARRC and Fed have abandoned finding an additional rate with credit sensitivity or finding an additive risk factor to append to new risk-free rates (RFRs). From the Fed, “[The] official sector does not plan to convene a group to recommend a specific credit-sensitive supplement or rate for use in commercial lending…” (See full letter here). This is a dead topic as indicated by the signatories: Mnuchin, Powell, Quarles, Williams, CFTC, SEC, OCC, FDIC. There will be no government-endorsed solution.

While many have proposed alternatives to add RFR risk sensitivity (CDX, IBYI, AXI, etc.), none are functionally tenable. Whatever is chosen for the “credit/risk proxy”, immediate viability is predicated upon two attributes:

- Existing market with interest-rate-like depth. Of the three above, only CDX exists today in a trade-able, all-to-all markets. CDX’s size and limited market makers are insufficient.

- All-to-All (futures) market. Most finance companies in the U.S. have no OTC, nor OTC-cleared capacity. The market must be one that all institutions can access: futures.

Adding a risk-sensitivity to the new RFRs is absolutely do-able today—quantifiable, executable and hedge-able in virtually any size, today. Part of the confusion is the ‘ask’: “We need credit sensitivity!”. The term ‘credit’ is imprecise and excessively inclusive. ‘Credit’ has become synonymous with ‘sensitivity to liquidity’, ‘sensitivity to all non-interest rate risk’ and/or ‘sensitivity to generic market stress levels’. RFRs, as well-noted during early covid-inspired market stress, go lower in rate when stuff hits the fan. The real ask from the lending universe is: “Give us a rate additive that counters RFRs declining in rate when markets are under duress.”

What causes the BIG (G-SIB) banks to reel in credit, jack up margins, blow borrowers out? The answer is volatility. When the ‘risk inventory’ of big banks starts to cause problems in volatile markets, these banks need to pare their risk to others because there is insufficient liquidity in the markets to allow for unwinding of the banks’ held positions. Sure, traders get told to cut risk, reduce inventory, ‘get small’. There is a level where taking senseless losses causes a gut-check. Bank regulators monitor this risk: Value at Risk (VaR).

VaR levels escalate rapidly in markets that are encountering massive, realized price volatility. One problem, in turbulent trading, often will beget another. As a rudimentary example, a bank may have a floating rate line out to XYZ Co. While the initial solution may be to cap or reduce the line, the existing exposure to XYZ Co becomes binary: (1) find a way to cut risk (typically involves short-selling the equity of XYZ Co, or, (2) blow them out and take the collateral backing the line. Depending on the collateral, (2) may be way worse than (1).

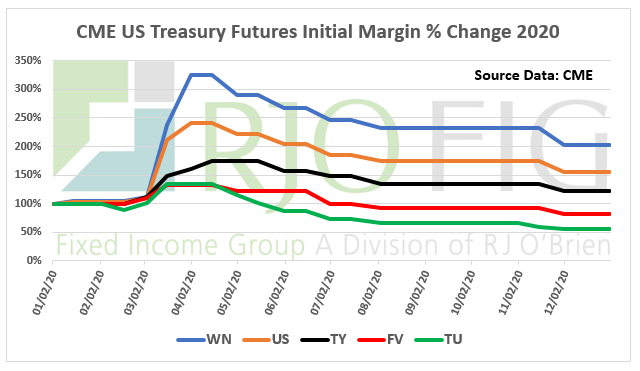

Futures exchanges also use VaR. Subsequent to the great financial crisis, Dodd/Frank regulations mandated three different margin requirements for derivatives, forever moving the market from the halcyon days of pre-GFC to “If it can be cleared, it must be cleared.”

Dodd/Frank set off the following margin rules:

- For an exchange (CCP) cleared future, 1-day historical VaR determines the margin

- For an exchange (CCP) cleared derivative, 5-day historical VaR sets the margin

- For uncleared (bilateral, contingent on counter-party size) , 10-day hVaR is used.

The internet is filled with information on VaR calculations (e.g. here). The bottom line is that when realized price volatility increases, margin requirement go up—at the CCPs and at the big banks.

With CCP-cleared futures, margins are universal. Whether long or short, possessing a shiny AAA credit or the worst of the worst, every futures user has to adjust their ‘ante’ (initial margin) when realized volatility is increasing (or decreasing). While the exchanges don’t “reduce lines based upon individual credit”, they universally require more margin to stay in the game—effectively an economic governor on all participants as risk rises.

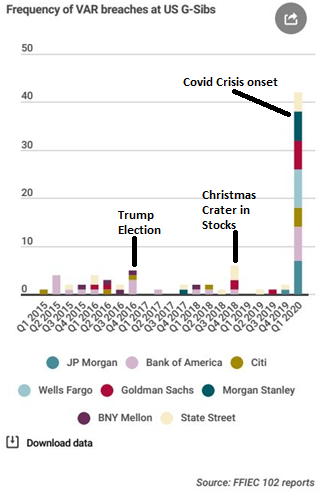

VaR is regulator-monitored for the big banks. These banks are allowed temporary breeches of VaR limits but there can be periods, like March’20, where volatility is protracted and problematic. The illustration of risk periods is historically visible via the FFIEC 102 Reports. (Source: FFIEC)

Ok, this sounds boring, but the graph of G-Sib VaR breaches absolutely highlights periods of major duress—the greatest of which in recent history was 1Q20:

So, seeking to alter the new RFRs to reflect stress in the system is not really about ‘credit’ per se. The RFR add-on is really about capturing events that cause bank stress—increases in bank VaR levels, elevated market volatility.

VaR though, is historical. It is realized. It is too late. What about an anticipatory, real-time solution?

“Markets are deepest when options are cheapest.” Unknown grain trader, Ceres Bar (CBOT), circa 1990.

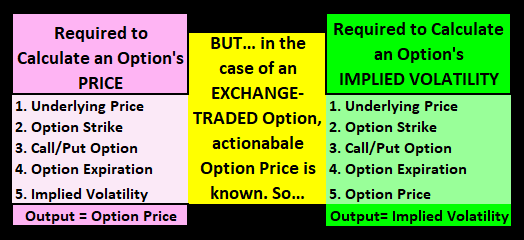

The corollary to the above is, “High option cost indicates risk.” The component of option pricing that dictates option cost is implied volatility. Where VaR is a function of realized (historical) volatility, option pricing is dictated by anticipated (aka “implied”) volatility. Option volatility leads. It may be cheap or rich to historical volatility. By the nature of being anticipatory, implied volatility is often wrong—it is the market’s best guess at forward risk. One thing is for certain: as actual/realized volatility surges in real-time, so does 30-day option implied volatility. Implied volatility is the cornerstone for building a “risk” add-on to new RFRs.

This piece is not intended to be a discussion about volatility models. Nor is it intended to be a math or statistics class. In keeping with those themes, consider:

Adding to the points from above are:

- Information needed to calculate Implied Volatility is freely available from websites– using cmegroup.com for settlements is enough.

- Options on rate futures are the deepest and most liquid of any option market—deeper than most any securities markets by magnitudes.

Interest rate options are accessible to any entity with a futures account. That can be any bank from smallest to largest, any non-bank institution, all the way down to qualified individuals with futures market access.

Free data source with extensive history, near-infinite liquidity, all-to-all accessibility.

How Does Change in Implied Volatility Translate into RISK?

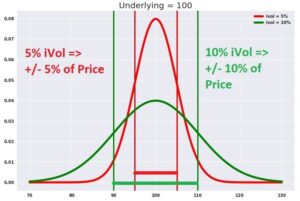

Implied volatility is often explained as, “The market’s traded estimate of an annualized 1-standard deviation range.” That may sound a bit cumbersome, but conceptually implied volatility answers the question, “Over the next year, how far up and down can a market move with ~68% certainty of settling within the range?” Implied volatility = Annualized 1-StD Range.

Rising implied volatility simply anticipates a wider range of possible prices, thus higher risk.

- Option implied volatility rises and falls with market-anticipated risk. In the case of Options on Treasury futures, the amount that ‘risk expectation’ changes is defined by units of price. As above, “A range expectation of +/-5 points.” (blue)

Converting “Points of Range Expectation” into Yield Equivalency

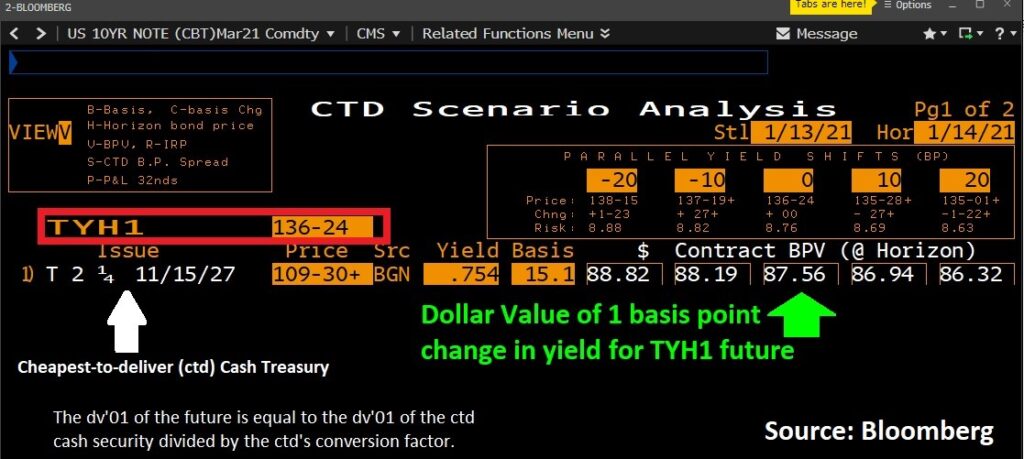

Treasury futures trade in price; 136’24 = 136.75 = 136.75% of $100,000 = $136,750 notional

Also, an interest rate sensitivity (aka ‘risk’, ‘bpv’, ‘dv01’) may be calculated for any Treasury future. Consider the benchmark of the Treasury futures complex: TY, currently ticker-ed as TYH1. To dodge the calculation herein, Bloomberg™ shows the risk for TYH1 as:

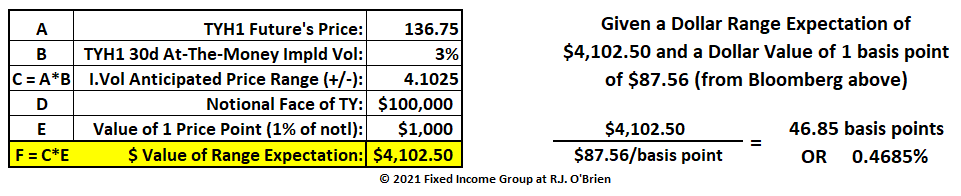

So, to calculate the expected forward volatility, in yield terms:

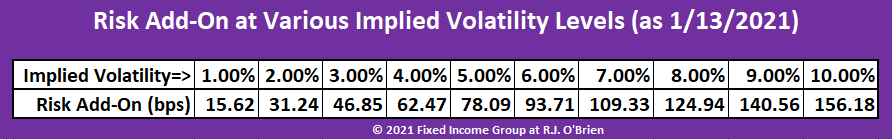

Further, the sensitivity of this implied-volatility-based ‘risk premium’ can be quickly calculated for any level of implied volatility. Holding everything else (above) constant and iterating over a range of implied volatilities:

***Note that both implied volatility and dv’01 of the underlying TY future change over time and at different interest rate levels. This serves substantially as a normalizing function.

Bottom line: Implied Volatility and Futures DV’01 can be utilized to create a real-time, risk-based yield ‘add-on’ to a riskless (RFR) rate. How would it work conceptually?

Constructing The ‘RFR+Risk Add-On’ Lending Rate

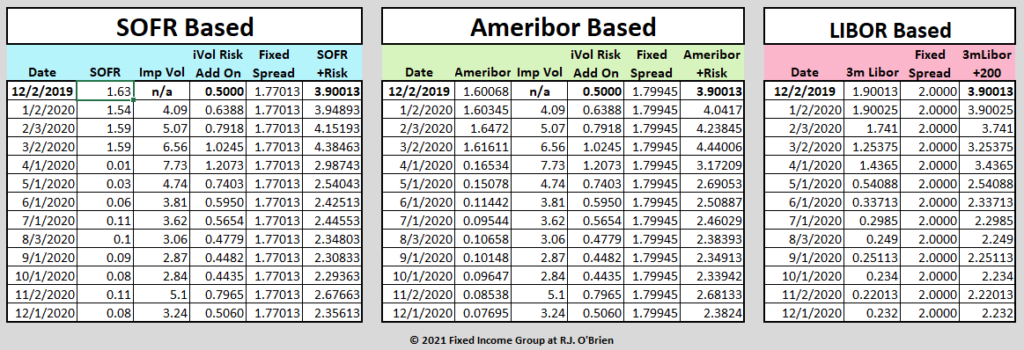

Today (1/13/21), a bank lends on a floating rate line at 3mo LIBOR + 200

With 3-month LIBOR at 0.23375, the Borrower’s rate is 2.23375%

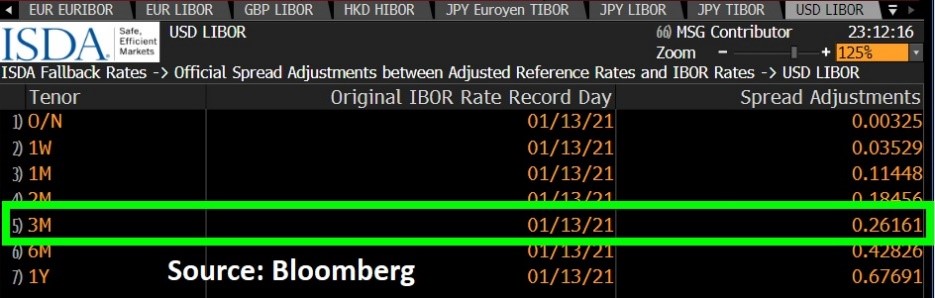

Checking LIBOR fallback spread levels (source: Bloomberg):

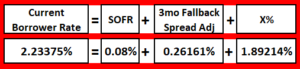

Given a 3mo LIBOR:SOFR fallback spread of 0.26161%. To back into our new Borrower rate:

3mo LIBOR +200 = Current Rate = SOFR + 3mo Fallback Spread Correction + X%

While that equation produces the “fair” transition rate (an identical rate being unimpeachably fair to the borrower), the Lender is now on the wrong side of lending off a risk-free benchmark. The Lender wants a risk add-on.

Over some length of time (like fallback spreads are measured), 50 basis points is found to be the median ‘risk add-on’ value. The initial Borrower rate could be expressed as:

As shown above, now the Lender’s rate is comprised of:

A) Floating RFR B) A Floating Risk add-on C) A Fixed (credit) add-on

The ‘Implied Vol Risk Add-On’ will likely change with every loan re-marking period (e.g. daily, monthly, etc.) just as the RFR is subject to change—both float and reset. The fixed “+X%” is constant.

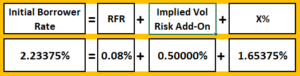

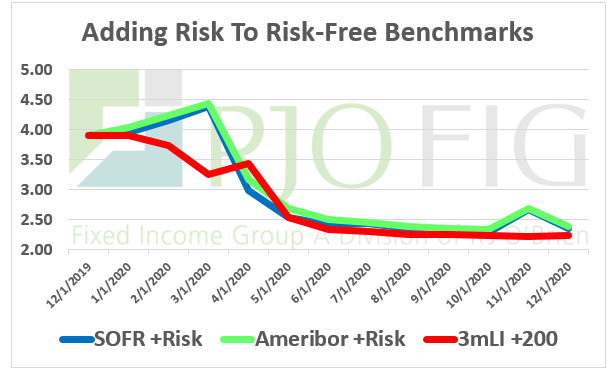

Did this work during the coronavirus disaster? Comparative rates were what?

Marking on the first business day of each month:

Comparing these alternatives graphically:

I am not a single-name credit person. Lenders, however, are folks teeming with credit specialists. It is entirely possible that 100% of iVol-based risk add-on may be too much (or little). I will leave it to the credit specialists at the lenders to derive a coefficient to the ‘risk add-on’ as needed. While beyond the scope of this piece, ratios of dv’01s between loan maturity and TY dv’01 may be used.

Some other thoughts and questions…

“How will this ever fit in any system I have?” Where you used to enter LIBOR, enter RFR+Risk add-on, combined into a single rate.

“If I construct a loan in this manner, my counter-party won’t be able to hedge and fix their risk.” Incorrect. SOFR and Ameribor can be fixed, using STIR futures out to two years. CME/Eris has term (forward looking, ahem) swap futures trading further out the curve and building liquidity. Handling the dollar offset for change in Borrower’s rate due to change in implied volatility is executable, using TY options, thru a vega immunization trade (beyond the target of this piece). There is an incremental decay cost on these hedges over time. So, a hedger has the ability to bifurcate rate hedges from vol hedges and execute either or both according to their views.

“If the data is free, where do I get it?” CME Group publishes their option and underlying settlements daily on their website. To calculate a 30-day implied volatility typically takes interpolation between at-the-money iVols of two option expiries. We do that and will be publishing those daily risk add-ons on our website (where you may also see 1mo/3mo/6mo/1yr forward-looking term rates for SOFR and AMERIBOR—with archived history—www.fixedincomegroup.com)

“John, you’re a knucklehead. Why didn’t someone else bring this up already?” Great question- our group was focused on trying to find a credit solution (via CDX futures). We had some pretty cool ideas but liquidity isn’t sufficient for the magnitude of need. The other folks that may have come up with this solution are hyper-focused on how to sell more data on some new gizmo index. That probably took up all of their time. Some folks just aren’t interested in coming up with solutions that are low-margin, easy to use, all-to-all futures solutions. There’s a lot more money in illiquid, invisible stuff. Absent those shots at certain parties (myself included), there is quite a bit of logic moving from TY option to risk add-on. It makes all the sense in the world though is obscured by being a non-traditional/non-credit solution. Bank VaR stress is the key.

“Has TY iVol always been a good measure for risk and market stress?” Yes, in the last 3+ decades I’ve been involved. Here are a few examples of where TY implied vols have traded during the GFC, Trump election, 2018 year-end melt-down, and of course covid. The latter three of these were highlighted on the FFIEC VaR Breaches earlier. All four graphics sourced from Bloomberg:

- Great Financial Crisis:

- Trump Election:

- 2018 Year-End “Christmas Crater”:

- Coronavirus:

- Ebola Scare:

In Conclusion: the yield equivalent to implied volatility of options on Treasury Futures fulfills the main objectives to be the ‘risk add-on’ to new RFR benchmarks: near infinite liquidity, no data cost, accessible to virtually all institutions via exchange-traded futures market, can fit into existing LIBOR+x systems, works when bank stress is elevated.

There are a good many lenders that are still holding out on the new RFRs. That has to stop. Credit lines need to be converted from LIBOR to new RFRs asap. This piece offers a good, sustainable, immediately implementable solution to adjusting the risk-free component of the RFRs.

Please reach out to our team with ideas and questions. fig@rjobrien.com

JC – on behalf of the Fixed Income Group at RJO

DISCLAIMER This material has been prepared by a sales or trading employee or agent of R.J. O’Brien and is, or is in the nature of, a solicitation. This material is not a research report prepared by R.J. O’Brien’s Research Department. By accepting this communication, you agree that you are an experienced user of the futures markets, capable of making independent trading decisions, and agree that you are not, and will not, rely solely on this communication in making trading decisions.

DISTRIBUTION IN SOME JURISDICTIONS MAY BE PROHIBITED OR RESTRICTED BY LAW. PERSONS IN POSSESSION OF THIS COMMUNICATION INDIRECTLY SHOULD INFORM THEMSELVES ABOUT AND OBSERVE ANY SUCH PROHIBITION OR RESTRICTIONS. TO THE EXTENT THAT YOU HAVE RECEIVED THIS COMMUNICATION INDIRECTLY AND SOLICITATIONS ARE PROHIBITED IN YOUR JURISDICTION WITHOUT REGISTRATION, THE MARKET COMMENTARY IN THIS COMMUNICATION SHOULD NOT BE CONSIDERED A SOLICITATION.

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results. Trading advice is based on information taken from trades and statistical services and other sources that R.J. O’Brien believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades.

CONTACT

222 South Riverside Plaza, Suite 1200

Chicago IL, 60606

P. (800) 367-3349

fig@rjobrien.com

© 2025 R.J. O'Brien & Associates LLC. | Site by :: kirkgroup

Futures trading involves the substantial risk of loss and is not suitable for all investors. Past performance is not indicative of future results.