Understanding Treasury Futures Roll Spreads

August 2020

I. The Misunderstanding of Roll Spreads Implying Convergence/Carry/Drop

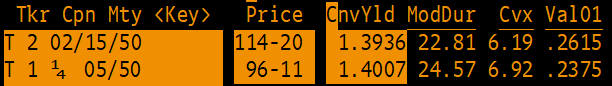

Treasury Futures are different from most other forms of forwards. With a typical forward, a security with a price of 100 today (spot), may have a price of 99.75 a month forward. By inference, buying the forward at 99.75, the forward will converge to the current spot price of 100. The ‘carry’ on the forward is: 100.00 – 99.75 = 0.25. Treasury futures do not work this way. They do not “roll up the curve” like a traditional forward, based upon a specific security and a cost-of-funds for a period from ‘today’ to ‘forward date’. Why not? The key is that Treasury Futures are not a forward on a single, specific security. Treasury Futures have a known basket of eligible-for-delivery securities. Determination of which security is most likely to be delivered helps define a Treasury Futures price. While virtually no one who uses Treasury Futures to hedge generic interest rate exposure will get involved with making or taking delivery, understanding that these futures typically have a DIFFERENT deliverable helps explain why a December future does not converge to a September future’s price. Two different securities may converge on a yield at a maturity. That does not imply that their prices will converge. As a simple example (source: Bloomberg):

Two securities trading at virtually identical yields (above), have decisively different convergence levels over time. In the extreme, both of the above bonds are converging to par, 100-00, as they approach maturity. Thus, the 2% security at a price of 114+ will lose some 14+ points on approach of maturity, while the 1.25% security will gain some 3+ points over a similar timeline. So, in the case of Treasury Futures, where the ultimate deliverable security is not usually the same from quarterly roll to quarterly roll, the difference in futures prices from quarter-to-quarter do not typically share the same price convergence path. We cannot infer anything about ‘carry’ from roll spread relationships. A bunch more information is required.

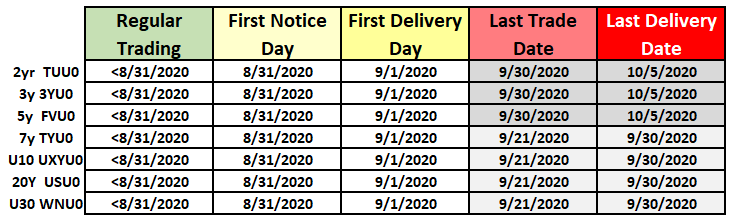

II. Timing of Rolling Treasury Futures

Most Treasury Futures users will never make or take delivery. For any LONG in a Treasury Future that is not interested in taking delivery, these positions will roll to the more-forward Treasury future before ‘First Notice Day’. Since the Delivery Option rests with the SHORT, short positions do not have to be rolled before First Notice Day—though, for liquidity reasons (and operational angst), most SHORTs that do not intend to deliver get out of the way via rolling on or before first notice. If you are a hedger or speculator, but not an arbitrage trader, the two or three days prior to first notice day are absolutely your target days to roll.

III. The Deliverable Basket, Conversion Factors, and Cheapest-to-Deliver

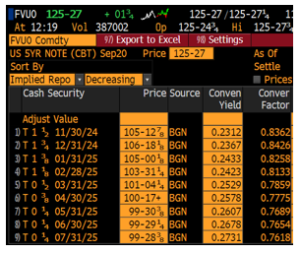

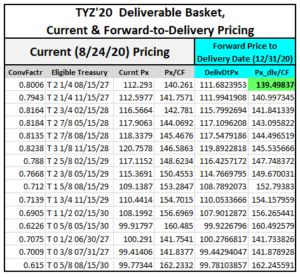

The concept of a Treasury Future is reasonably logical. The Treasury Future behaves like the cash Treasury security that is expected to be delivered. If there are several likely possibilities, the future behaves like a hybrid: performance emulates a probability-of-being-delivered weighting. The ‘short’ decides which security to deliver. The specific security choices for the short are defined by the ‘deliverable basket’. Depending on the “which future” (say, TY vs US), the basket may have a different number of securities eligible. Eligibility of a security to be in the basket is determined by time to maturity—so, cash Treasury issuance determines ‘how many’ potentially-deliverable securities are in the basket. (source: Bloomberg):

For the September 2020 5-year future (FVU0 as shown to the left), there are nine eligible cash Treasury deliverables. Prior to last delivery date, there will be another security issued, the next cash 5-year, that will also be eligible. We can’t ‘know’ the specifics on that issue, so assumptions are made and its potential for delivery are hypothetical at this point. Securities may be added to the basket over the life of the future due to new issues. None are removed.

How would a trader decide which security to deliver? There has to be a ‘normalization’. That normalization is accomplished by re-casting each deliverable security into a 6% coupon. Obviously, the normalized coupon is well above market today, illustrating that this attribute of Treasury Futures is quite old! The “Conversion Factor” (CF) is the normalizing factor. Each cash security that is deliverable has its own CF—as shown in the right-most column of the above graphic.

Cash Treasury securities trade in ‘clean price’. The price traded in a cash Treasury is invoiced separately from the accrued interest. This separation allows for normalization of a clean price via Conversion Factor. Using the Conversion Factor, a Treasury Futures short can determine which bond is Cheapest to Deliver (CTD). The Treasury security that is CTD largely determines the performance characteristics of the Treasury Future.

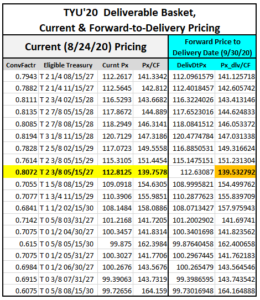

To determine the CTD security in the future’s basket, the price of each eligible security is divided by its Conversion Factor. The lowest CF-adjusted price, priced forward to delivery date, is the CTD security:

To calculate the forward clean price of a Treasury, the =PRICE() function on Excel may be used. Once the price of each eligible Treasury security is calculated to find its ‘forward price on delivery date’ (in blue, DelivDtPx), those forward Treasury prices are divided by each of their respective Conversion Factors to determine which security is CTD—cheapest. For TYU0, the price is highlighted in orange. The short delivers the cheapest available.

“Isn’t this piece about ROLL SPREADS?”—Yes, and the complexity of the CTD logic must be sorted first. When attempting to value the spread, the CTD for the more-forward Treasury Futures contract (currently, Dec’20) must also be calculated.  The same calculations are deployed for the more-deferred future, TYZ’20. The key variable that changes is the Delivery Date (12/31/20 here). The forward price to 12/31/20 is calculated for each cash security eligible for delivery. Again, the security with the lowest Conversion Factor-adjusted forward price is CTD (green).

The same calculations are deployed for the more-deferred future, TYZ’20. The key variable that changes is the Delivery Date (12/31/20 here). The forward price to 12/31/20 is calculated for each cash security eligible for delivery. Again, the security with the lowest Conversion Factor-adjusted forward price is CTD (green).

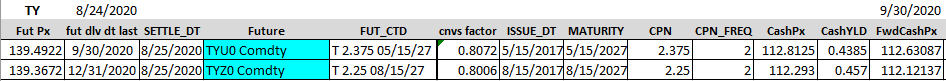

These two calculation grids yield the CTDs for each of the TYU20 and TYZ20 futures:

- T 2 3/8s of 5/15/27 is CTD for TYU20

- T 2 1/4s of 8/15/27 is CTD for TYZ20

IV. Calculating the Fair Value of the Roll Spread from the CTD’s

Using the =PRICE() function on Excel, calculate the forward cash CTD prices to 9/30/2020 (Sep Deliv Dt):

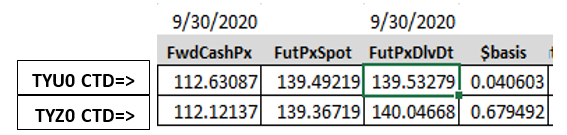

Using the FwdCashPx on 9/30, calculate the futures prices for each CTD by: FwdCashPx/ConvFactor. The result (FutPxDlvDt, below) is the unadjusted futures price on 9/30/20 for each of the TYU0 and TYZ0 contracts. In the case of TYU0, 139.53279 IS the futures equivalent delivery price. This value is not adjusted further. The Dec’20 value, however, presents a problem. The conversion factor for DEC’20 is calculated based upon a last delivery date of 12/31/20, not 9/30/20. To rectify the problem, the gross ‘basis’ is calculated for each Treasury Future. The basis defines ‘curve roll up’ for the futures contract between ‘today’ and ‘forward price date’. The basis is the difference between spot futures price and the futures price on delivery date, FutPxDlvDt. (Final Future Price) – (Spot Futures Price) = Basis

In the case of TYU0, with a basis of 0.040603 points, or 1.2993 ticks, all things held steady, the TYU0 future will appreciate by 1.2993 ticks between now and delivery (9/30/20). At delivery, the basis will be zero because the invoice price for the CTD will be the same as the futures settlement price, adjusted for the conversion factor. Bottom line: TYU0 will roll up the curve by 0.040603 points.

As mentioned earlier, each eligible-to-deliver security for each Treasury future has a unique conversion factor. The CF translates the cash Treasury clean price into the equivalent price for a 6% coupon. This equalization translates to: “The change in clean price of all 6% Treasury securities from today to some forward date must be the same by ‘no arbitrage’.” Or, same credit, same partial term, same discount rate = same ΔPV.

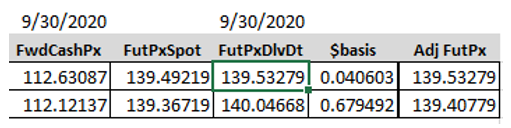

To correct the forward futures price for TYZ0 (Dec20): TYZ0_FutPxDlvDt (140.04668) – TYZ0_$basis (0.679492) + TYU0_$basis (0.040603)= TYZ0 on 9/30/20

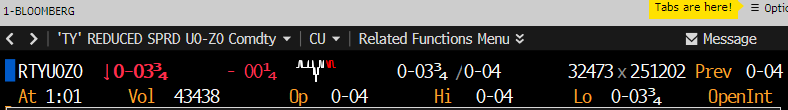

From here, the fair value of the TYU0/TYZ0 spread is simply the difference of the Adjusted Futures Prices: TYU0 (139.53279) – TYZ0 (139.40779) = 0.125 points or 4/32. The open market bid/ask of the roll spread? Real time source: Bloomberg

JC for the Fixed Income Group at R.J. O’Brien

For further information contact The Fixed Income Group at RJO:

800-367-3349 FIG@rjobrien.com

DISCLAIMER This material has been prepared by a sales or trading employee or agent of R.J. O’Brien and is, or is in the nature of, a solicitation. This material is not a research report prepared by R.J. O’Brien’s Research Department. By accepting this communication, you agree that you are an experienced user of the futures markets, capable of making independent trading decisions, and agree that you are not, and will not, rely solely on this communication in making trading decisions. DISTRIBUTION IN SOME JURISDICTIONS MAY BE PROHIBITED OR RESTRICTED BY LAW. PERSONS IN POSSESSION OF THIS COMMUNICATION INDIRECTLY SHOULD INFORM THEMSELVES ABOUT AND OBSERVE ANY SUCH PROHIBITION OR RESTRICTIONS. TO THE EXTENT THAT YOU HAVE RECEIVED THIS COMMUNICATION INDIRECTLY AND SOLICITATIONS ARE PROHIBITED IN YOUR JURISDICTION WITHOUT REGISTRATION, THE MARKET COMMENTARY IN THIS COMMUNICATION SHOULD NOT BE CONSIDERED A SOLICITATION. The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results. Trading advice is based on information taken from trades and statistical services and other sources that R.J. O’Brien believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades.

CONTACT

222 South Riverside Plaza, Suite 1200

Chicago IL, 60606

P. (800) 367-3349

fig@rjobrien.com

© 2025 R.J. O'Brien & Associates LLC. | Site by :: kirkgroup

Futures trading involves the substantial risk of loss and is not suitable for all investors. Past performance is not indicative of future results.