Calculating Term Fixed Rates Using 1mo Ameribor Futures AND Term Rate Applications

June 2020

Before the applications, calculating a compound fixed rate from Ameribor futures is needed. These compound rates are also an essential piece needed to calculate simple interest. Using the 1-month Ameribor Futures, we can use the Fed’s favorite calculations (as applied to SOFR) to calculate our Term Ameribor rate. Note: we assume 360 annual day count for all calculations below.

1-month Ameribor futures settle to the AVERAGE daily overnight Ameribor rate traded on the spot platform. So a futures price of 9990 implies an average rate of 0.10% on the Ameribor platform from 7/1/2020-7/31/2020. As today is 6/19/2020, the price of the July 1mo Ameribor future is no more than the trade-able expession of “the market’s best guess” as to what the average rate will be over the month of July. As expectations and money flow change, the future price will trade up and down accordingly.

During the futures ‘valuation month’, as rates become known, the futures price will accrue to greater certainty of final price (each day fixes one or more days of rates for the final settlement calculation). Whatever rate is published for cash Ameribor preceding a weekend or holiday, will be the rate for the non-trading days. So, the rate for Wednesday, July 3rd, will be the rate that is used for holiday July 4th and ‘averaged in’ to the final settlement value of the July Futures Contract.

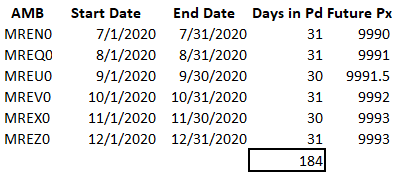

To frame an example, a 6-month term rate from July 1, 2020 through Dec 31, 2020 will be used.

Step 1: Rendering Annualized Term Rates from Ameribor Futures:

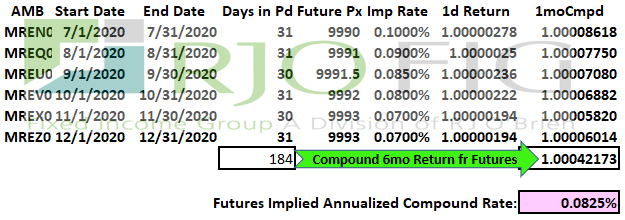

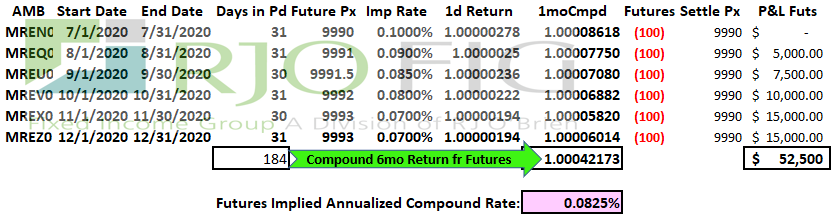

- A) First, we gather the specifics on the 1mo Ameribor futures covering our 6-month period:

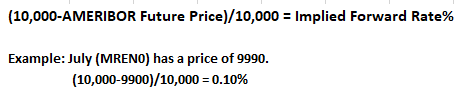

- B) The Ameribor futures are priced such that:

- C) Adding to our table for all involved 1mo Ameribor futures:

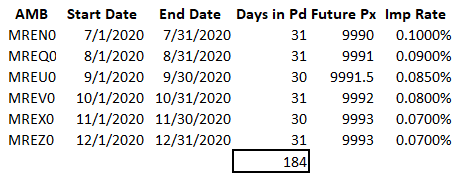

- D) One of the less-obvious components to using 1mo Ameribor futures to calculate a term forward rate stems from the ‘average’ (not compound) daily settlement values over a month. To calculate term rates from average rates, it is necessary to first calculate 1-day Rate of Return values for the futures. To calculate the 1-day implied return on $1.00, we use the expression:

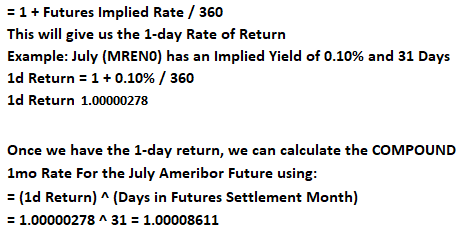

- E) Expanding the calculation grid to include 1-day returns & implied 1mo compound returns:

Also, notice (via the GREEN arrowhead, that calculating the compound 6-month return is now simple. Take the product of the six 1-month returns.

- F) Finally, in the pink box above, annualized rate may be calculated by annualizing the 6-month futures-implied return:

![]()

Step 2: “Show me the money!” Does all this math tie out?

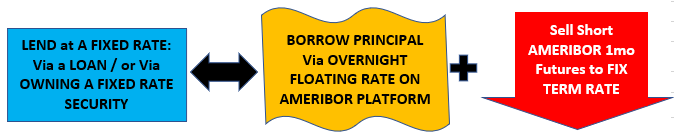

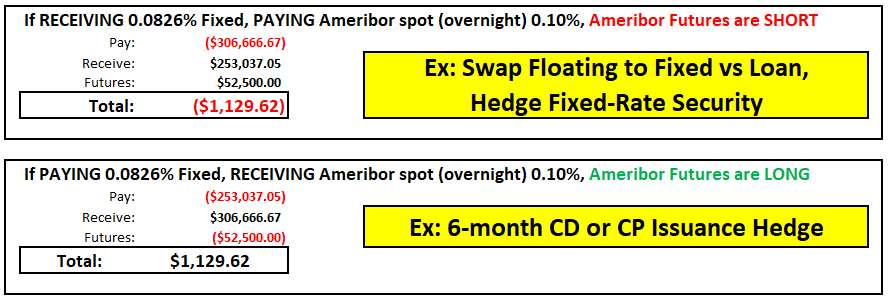

Let’s choose a big and convenient number: $600,000,000. Each 1mo Ameribor future has a notional value of $6mm. Thus, to fix $600mm in Ameribor from July 1 to Dec 31, we’ll need a short of 100 of each of the Jul, Aug, Sep, Oct, Nov and Dec 1mo Ameribor futures. In Selling Short 100 of the 1mo futures in each of the six months, we will lock up the ‘fixed rate’ calculated above: 0.0825%. We lend principal out to a borrower (BLUE BOX below) and receive a fixed rate, borrow the principal on the Ameribor Cash Platform, and short the futures to hedge the term rate:

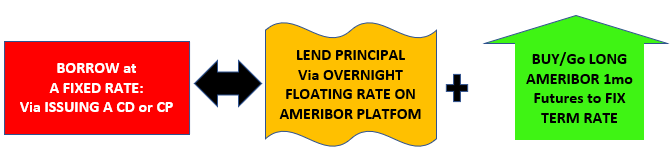

OR, the opposite where we are PAYING a fixed rate, such as a CD or commercial paper we issue:

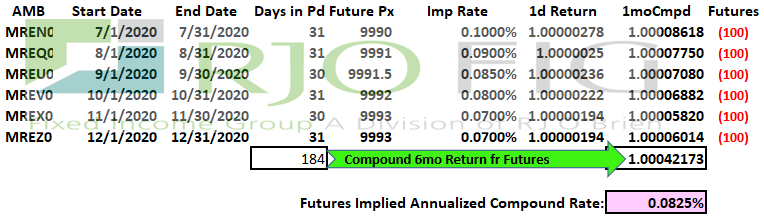

Using the BLUE BOX example, ‘LEND at a Fixed Rate, Borrow Overnight on Ameribor platform, Sell Short Ameribor Futures, we adjust our grid to:

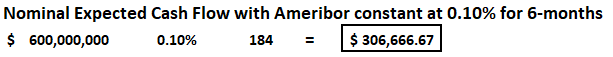

Let’s further stipulate that Ameribor remains unchanged for the entirety of the six-month period; steady at 0.10% for 184 days. We can then render a P&L for the 1mo Ameribor futures over the period:

Looking at the economics:

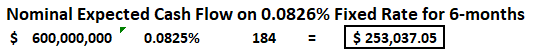

The 0.0825% rate calculated, and ‘fixed’, via the 1mo Ameribor futures, would equate to:

Notional $ * Rate * Days in Period / 360

If we hedged a 6-month loan, borrowing overnight at 0.10% every night for the 184 days, cost of funds would be:

That leaves the short futures component to the P&L (from the above grid), if Ameribor daily rates settled at 0.10% every day, the futures would all settle to their respective monthly averages, 0.10%– or, 9990 futures price. Recall that the Ameribor futures are $50 per basis point per contract. So a move from 9995 to 9990 would be 5 basis points. A SHORT position would ‘earn’ 5bps per contract: 5bps*$50/bp=$250 per contract short. These settlements of futures over the six months would result in the following P&L:

Completing out the cash-flow-based, total P&L:

As to ‘position hedged ineffectiveness’:

1 – (($253,037.05+$52,500)/306,666.67) = .00368

Or, 99.632% effective.

JC, for the Fixed Income Group at R.J. O’Brien

800.367.3349

fig@rjobrien.com

Link to PDF HERE

DISCLAIMER

This material has been prepared by a sales or trading employee or agent of R.J. O’Brien and is, or is in the nature of, a solicitation. This material is not a research report prepared by R.J. O’Brien’s Research Department. By accepting this communication, you agree that you are an experienced user of the futures markets, capable of making independent trading decisions, and agree that you are not, and will not, rely solely on this communication in making trading decisions.

DISTRIBUTION IN SOME JURISDICTIONS MAY BE PROHIBITED OR RESTRICTED BY LAW. PERSONS IN POSSESSION OF THIS COMMUNICATION INDIRECTLY SHOULD INFORM THEMSELVES ABOUT AND OBSERVE ANY SUCH PROHIBITION OR RESTRICTIONS. TO THE EXTENT THAT YOU HAVE RECEIVED THIS COMMUNICATION INDIRECTLY AND SOLICITATIONS ARE PROHIBITED IN YOUR JURISDICTION WITHOUT REGISTRATION, THE MARKET COMMENTARY IN THIS COMMUNICATION SHOULD NOT BE CONSIDERED A SOLICITATION.

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results. Trading advice is based on information taken from trades and statistical services and other sources that R.J. O’Brien believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades.

CONTACT

222 South Riverside Plaza, Suite 1200

Chicago IL, 60606

P. (800) 367-3349

fig@rjobrien.com

© 2025 R.J. O'Brien & Associates LLC. | Site by :: kirkgroup

Futures trading involves the substantial risk of loss and is not suitable for all investors. Past performance is not indicative of future results.