RFR Alts: ICE Bank Yield Index & Bloomberg BSBY vs FIG-Proposed iVol-based Risk Add-On (part 2)

January 2021

- See Part 1: What is this iVol-based RFR Add-On? Click Here for Part 1

- To view RJO FIG’s historic RFR Alt Data, click here.

Premise: Because Bank-Dealer Risk is a function of Realized Volatility (FFIEC-reported VaR), a Risk Add-On should target Anticipated Volatility (Option Implied Volatility).

Bank Stress = Volatility

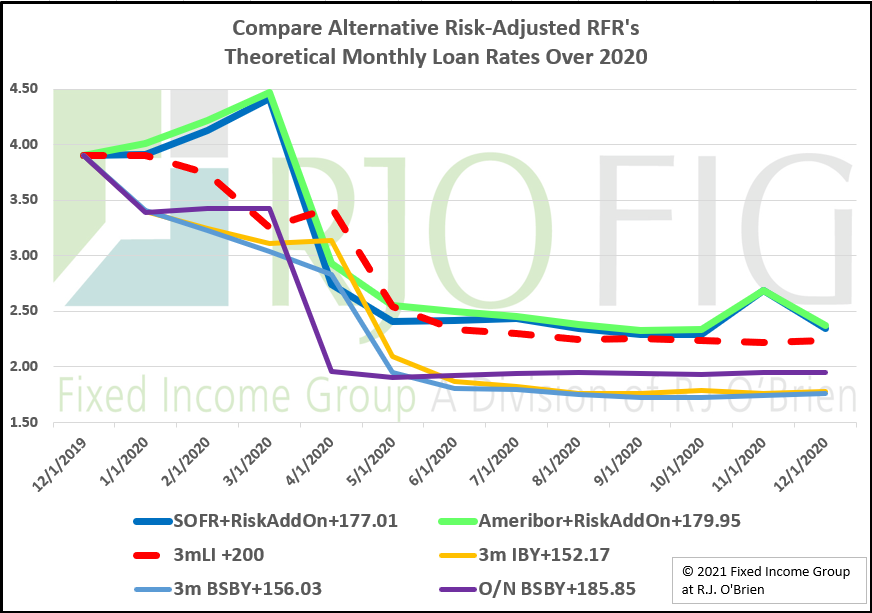

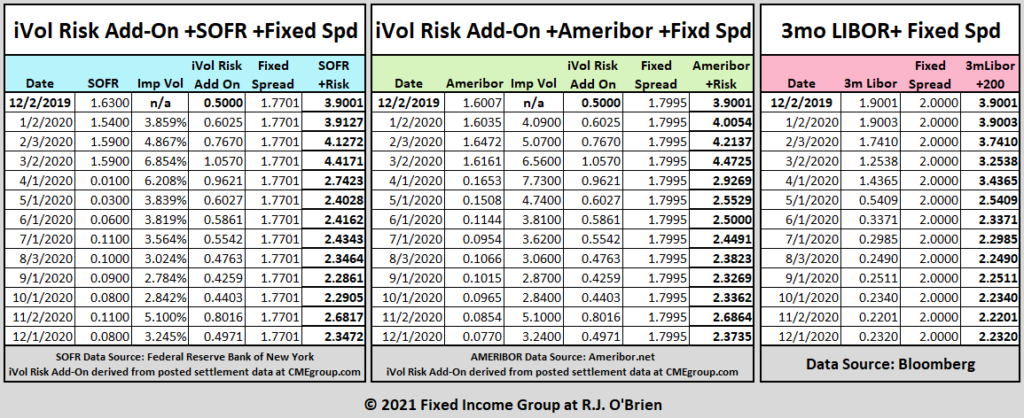

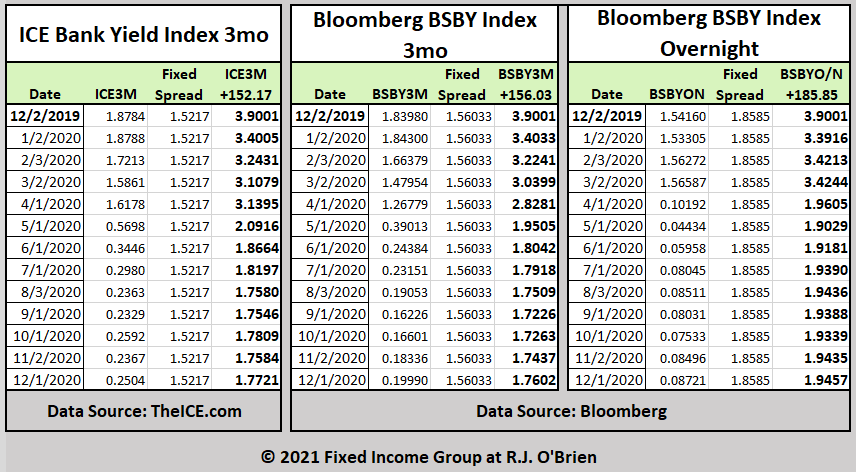

Consider six loans that all began 12/02/2019. The base case is 3mo LIBOR + 200 basis points. All six loans have IDENTICAL starting rates on 12/02/2019, equal in rate to LIBOR+200 at the onset.

The ‘convenience’ of LIBOR was undeniable. Prior to September 21, 2008, after which Goldman and Morgan Stanley were ‘bankified’, LIBOR (and LIBOR swaps) had bona-fide AA Financial credit risk (Colin-Dufresne & Solnik here and elsewhere). After 9/21/2008, LIBOR was never the ‘credit sensitive’ index many think it still is. In fact, what kept LIBOR rates from plummeting in the Covid-crisis, was nothing more than LIBOR’s new dependence on FX-implied cost of funds. Few ask, but all should, if there was any inter-bank credit reflected in LIBOR, “How did Ameribor (non-GSib banks) decline with SOFR, while LIBOR (GSib banks) remain stubbornly elevated in the early part of Covid?—LIBOR is just international US Dollar liquidity in a crisis today. None of the other LIBOR inputs trade (CP/CD, etc), often for months, during any systemic duress. Notice what happened to LIBOR subsequent to the Fed adding USD swap lines to every central bank with a computer—LIBOR declined. LIBOR is dead. Enough of that.

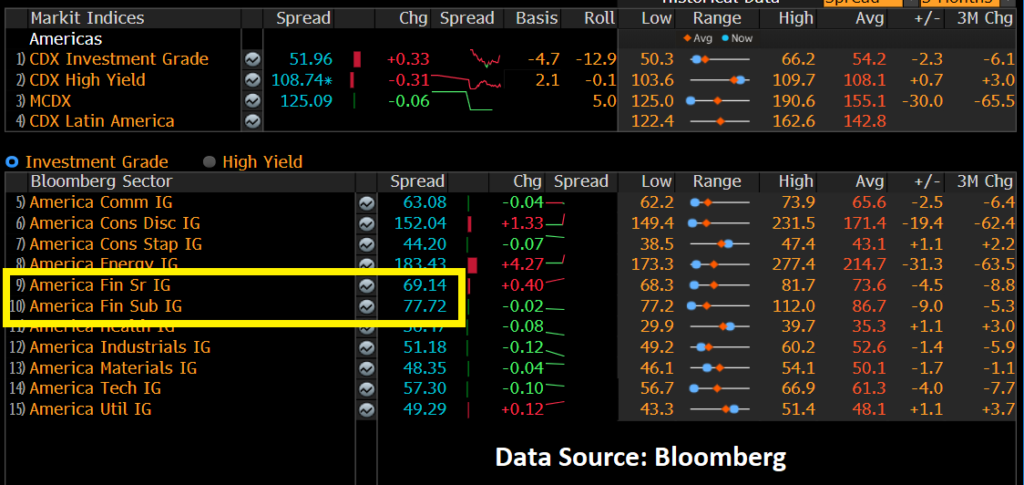

LIBOR had both RFR and Risk components embedded in a single benchmark. With SOFR and Ameribor, we have the RFR piece, and need to add the risk. “Credit” is way too inclusive. If you talk to a credit trader about risk-layoffs for broad credit exposure (e.g. CDX), the traders should tell you the risk layoff is volatility. CDX_HY?- lay it off with VIX. Sure, versus single-names, underlying equities are frequently ‘the short of choice’. That response is due to the impossibility of buying single-name volatility (aka “equity options”) when there is stress. No one makes ‘size’ markets for single-name equity options when all hell is breaking loose. See more here from the credit trading veteran @olivier sarfati with whom I was fortunate enough to present with at CBOE’s RMC 2019 (back when we had conferences in actual conference rooms). The bottom line here is: pro traders and market makers lay off credit risk using volatility offsets when possible.

The other characteristic—the really important feature of electing ‘implied volatility’ over ‘credit’ as a risk add-on: Implied volatility LEADS the risk where credit is contemporaneous with the stress event. Why?—because when big banks have problems, they start buying volatility to bring down mark-to-market stress levels.

I’m not against new products. Heck, put me in the ‘all-ya-got’ category. But whatever the risk add-on is, it must be highly correlated (or a direct subset) of something that trades, enormously, already. Why? Because Market Makers and Liquidity Providers must have some instrument(s) they are certain they can trade in all markets to offset the risk. The position hedge.

Derivative markets are not like ETFs. Banding a bunch of stuff together and saying, “Hey, look, here’s another really cool new thing to trade” does not work. Derivatives are zero-sum. One party must lose for another party to gain. So, to create an index of any value—especially one that will be expected to support trillions of notional in lending—there must be a low cost / high liquidity layoff for the market makers. What, exactly, will any market maker use to layoff risk on any of these alterative add-ons? The answer is ‘does not exist’ or we’d have no need for these Alt-Risk Add-Ons. We’d use the layoff instrument for the kind of size we are talking about.

So, the problem is not with IBY nor BSBY nor any other creation. The problem is the products can’t be derivative-ized without market makers. There will be no market makers because there is no risk layoff. The less correlated the risk layoff, the wider (if any) markets will be. Over time, perhaps one or more of these indices (or some other index) will work. Not this decade. For a very tangible example, SOFR and Ameribor are and have been highly correlated to OIS-FedFunds. There has been an OIS term-rate swap market for decades. Yet, even with a decent layoff, there are only wide, semi-liquid, term markets in SOFR and none (until Citi gets there) for Ameribor. Most futures traders layoff both SOFR and Ameribor STIR futures against Fed Funds futures contracts. Most of the volume in STIR futures has failed to expand much past two years—the terminal liquidity point for Fed Funds futures. I will offer a well-deserved shout out to CME/Eris SOFR Term futures that are gaining rapid traction. See here.

On a final note: No market makers hand out free options. With no obvious risk layoff, any ‘uniquely-crafted’ credit add-on will be expensive—perhaps impossibly expensive. Why? The purpose of these Alt-Add-Ons is to “add credit exposure”. Yes, and when one insures against credit spreads widening, they do NOT get that insurance for free. Akin to CDX, as time passes, cost to the credit risk hedger mounts. How much for a new, illiquid, untested index that is expected to reflect bank risk? I’d put it at 1.5x-3x Financial CDX.

1x would be about 72bps (6bps a month in negative carry). Thus, my guess is 9-18bps per month in negative carry to the hedger. That sounds a bit ‘hot’. None of it matters without market makers. To be viable, there has to be a visible, immensely liquid, layoff market. None exists that I can see for IBY or BSBY.

With existing RFRs, banks can borrow and lend with each other, overnight, at the Ameribor rate, right now. Bilateral. Some banks, can borrow and lend at SOFR too.

It is when those RFR inter-bank lending circles ‘look outward’ to lend to non-banks, they need a simple floating-rate risk add-on, in addition to a fixed rate (credit) add-on, to offer to borrowers: Floating RFR + Floating Risk Add-On + Fixed Credit Spread.

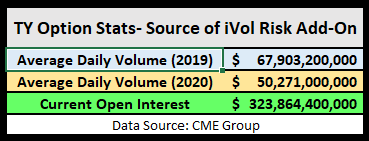

What we have proposed, the FIG vol-based alternative (see part 1, link at top of article or here), is FREE of data costs, fully “open source”, and already has market makers on $50 billion+ in average daily trading volume. Is the FIG vol-based solution imperfect?- yes. It will be up to bank credit departments to find the correct coefficient to apply to the FIG risk add-on, based upon loan terms, collateralization and borrower credit.

We need to get banks to lend at RFR+Risk Add-On + Fixed Spread. If a bank decides to forego using the risk add-on and is comfortable lending at a fixed spread over SOFR or Ameribor, fabulous. Lines and loans need to be transitioned to SOFR+ or Ameribor+ now. Not in decades. And, any solution requires an underlying with substantial depth and trading history, full transparency, and full all-to-all market trading access. We are still fighting to build liquidity in SOFR and Ameribor term curves, which is challenge enough.

Finally, how big is the TY option complex that underlies the FIG vol-based add-on?

For the add-on alternatives, we find cumulative actual trading volume and resting positions of: $0.00

These indices are being sold as a “build it and they will come”. No market makers. No layoffs. No chance of success in any reasonable timeframe. Assuredly, the alternatives will not be free of data costs.

JC- for The Fixed Income Group at R.J. O’Brien. Please see our disclaimer below.

800-367-3349

fig@rjobrien.com

www.fixedincomegroup.com

DISCLAIMER This material has been prepared by a sales or trading employee or agent of R.J. O’Brien and is, or is in the nature of, a solicitation. This material is not a research report prepared by R.J. O’Brien’s Research Department. By accepting this communication, you agree that you are an experienced user of the futures markets, capable of making independent trading decisions, and agree that you are not, and will not, rely solely on this communication in making trading decisions.

DISTRIBUTION IN SOME JURISDICTIONS MAY BE PROHIBITED OR RESTRICTED BY LAW. PERSONS IN POSSESSION OF THIS COMMUNICATION INDIRECTLY SHOULD INFORM THEMSELVES ABOUT AND OBSERVE ANY SUCH PROHIBITION OR RESTRICTIONS. TO THE EXTENT THAT YOU HAVE RECEIVED THIS COMMUNICATION INDIRECTLY AND SOLICITATIONS ARE PROHIBITED IN YOUR JURISDICTION WITHOUT REGISTRATION, THE MARKET COMMENTARY IN THIS COMMUNICATION SHOULD NOT BE CONSIDERED A SOLICITATION.

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results. Trading advice is based on information taken from trades and statistical services and other sources that R.J. O’Brien believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades.

CONTACT

222 South Riverside Plaza, Suite 1200

Chicago IL, 60606

P. (800) 367-3349

fig@rjobrien.com

© 2025 R.J. O'Brien & Associates LLC. | Site by :: kirkgroup

Futures trading involves the substantial risk of loss and is not suitable for all investors. Past performance is not indicative of future results.