Situational Complexity in Sep’22 Treasury Futures Delivery Cycle & Associated Roll

August 2022

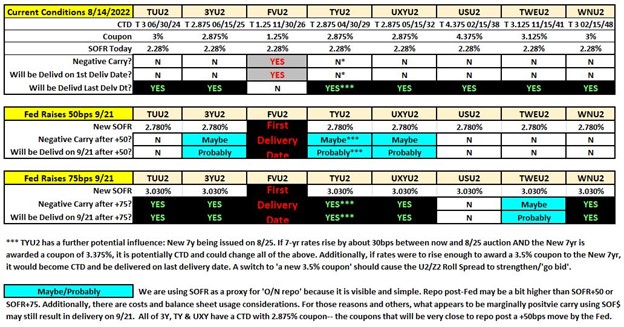

- The “big deal” this roll will center on the 7yr auction on 8/25. If that new coupon is 3.5% or higher, TYU2/TYZ2 roll spread (dv’01 neutral) will go bid.

- FVU2 will see delivery on First Delivery Date—early delivery.

Most of our clients will roll from Sep’22 to Dec’22 (U2/Z2) well before first delivery date. That will not change. This delivery cycle, though, is a confluence of numerous factors rarely (if ever in my career) seen simultaneously. It’s a mighty cool opportunity to learn a bunch more about the delivery process with real-time examples.

For those with interest, “what happens?” after first delivery notice day (‘1st notice’ is 8/31/22), is a near-complete tutorial in delivery situations, timing and potential ‘wild card’ option plays. The FOMC on 9/21 –mid-delivery cycle—is a rare ‘’anticipatable” volatility event that will catalyze the decisions and outcomes.

Early delivery in its simplest form is motivated by ‘negative carry’. Broadly, when the coupon on the ‘cheapest-to-deliver’ (“CTD”) cash Treasury is less than O/N repo, Treasury futures are in ‘negative carry’. Negative carry motivates ‘deliver cash into futures ASAP’.

The ‘wild card’ option value, amplified by low conversion factors, will have varied impacts on holding the basis through FOMC. For the FVU2 Treasury future, would a trader ‘eat’ the negative carry for a chance at a wild card option play? In the case of the Ultra 10yr (UXYU2), a very small conversion factor portends potential as well.

The Wild Card is often discussed and rarely fully explained. It is one of the goofier structural options embedded in Treasury futures. On and after First Delivery Date (9/1), the futures short gets a 2-hour option, each day.

The futures delivery price is established at the 2pm CT futures close. But the cash market continues to trade. If the CTD price rises enough in those last two hours (say, late equity market crash, etc.), the futures short may ‘exercise’ the Wildcard option—and deliver cash into the futures USING THE 2PM FUTURES PRICE.

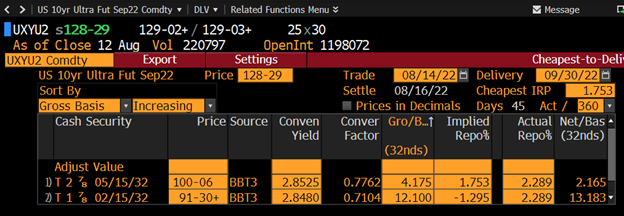

Let’s examine this in using specifics for UXYU2.

- UXYU2 Conversion Factor: 0.7762

For the basis trader (long CTD/short UXYU2), their position is:

-

Long $100mm T 2.875 5/15/32

-

Short 776 UXYU2 Futures

The futures position determines the notional to be delivered. If we have 776 UXY, delivery will be for $77.6mm of T 2.875 5/15/32. It is the ‘tail’ or excess cash of $22.4mm that drives the wild card option value.

The viability/exercisability of the wild card is determined by ‘how much’ the cash CTD tail ($22.4mm) appreciates in price between 2pm CT and 4pm CT. Why? Because the trader needs only to deliver 77.6% of notional, if gains on the tails exceed the gross basis (remaining carry to delivery), the trader will: 1) notify the exchange of intent to deliver, 2) deliver $77.6mm of T 2.875 5/15/32, and 3) Sell, in the cash market, the excess tails ($22.4mm). If the gain in the tails is greater than the total remaining carry to delivery, the trader should exercise this option every time (adjusting for slippage on liquidating the tails).

We’ll run the hypothetical from today’s basis levels.

Gross basis is 4.175/32s

The question, then, is: “How much would the tails have to move to exceed the total basis P&L to delivery?”

4.175/(100-CF) = 4.175/0.224 = 18.64/32s

If we were in the delivery window and the gross basis was where it is today, T 2.875 5/15/32 would have to rally by 19ish ticks after 2pm CT on a trade day after first notice day.

Of course, if the CTD were to rally more than the 19/32s, there would be a windfall to the trader. That is the Wild Card option.

In volatile periods, the option value (basis net of carry) can grow quite large; even for a 2-hour option.

JC- For The Fixed Income Group at RJO

DISCLAIMER

This material has been prepared by a sales or trading employee or agent of R.J. O’Brien and is, or is in the nature of, a solicitation. This material is not a research report prepared by R.J. O’Brien’s Research Department. By accepting this communication, you agree that you are an experienced user of the futures markets, capable of making independent trading decisions, and agree that you are not, and will not, rely solely on this communication in making trading decisions.

DISTRIBUTION IN SOME JURISDICTIONS MAY BE PROHIBITED OR RESTRICTED BY LAW. PERSONS IN POSSESSION OF THIS COMMUNICATION INDIRECTLY SHOULD INFORM THEMSELVES ABOUT AND OBSERVE ANY SUCH PROHIBITION OR RESTRICTIONS. TO THE EXTENT THAT YOU HAVE RECEIVED THIS COMMUNICATION INDIRECTLY AND SOLICITATIONS ARE PROHIBITED IN YOUR JURISDICTION WITHOUT REGISTRATION, THE MARKET COMMENTARY IN THIS COMMUNICATION SHOULD NOT BE CONSIDERED A SOLICITATION.

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results. Trading advice is based on information taken from trades and statistical services and other sources that R.J. O’Brien believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades.

CONTACT

222 South Riverside Plaza, Suite 1200

Chicago IL, 60606

P. (800) 367-3349

fig@rjobrien.com

© 2025 R.J. O'Brien & Associates LLC. | Site by :: kirkgroup

Futures trading involves the substantial risk of loss and is not suitable for all investors. Past performance is not indicative of future results.